Your Leading Mobile & Web Development Partner

Based in Canada & India, Specializing in Turning Your Vision into Reality

Get A Free QuoteStartup Success Stories

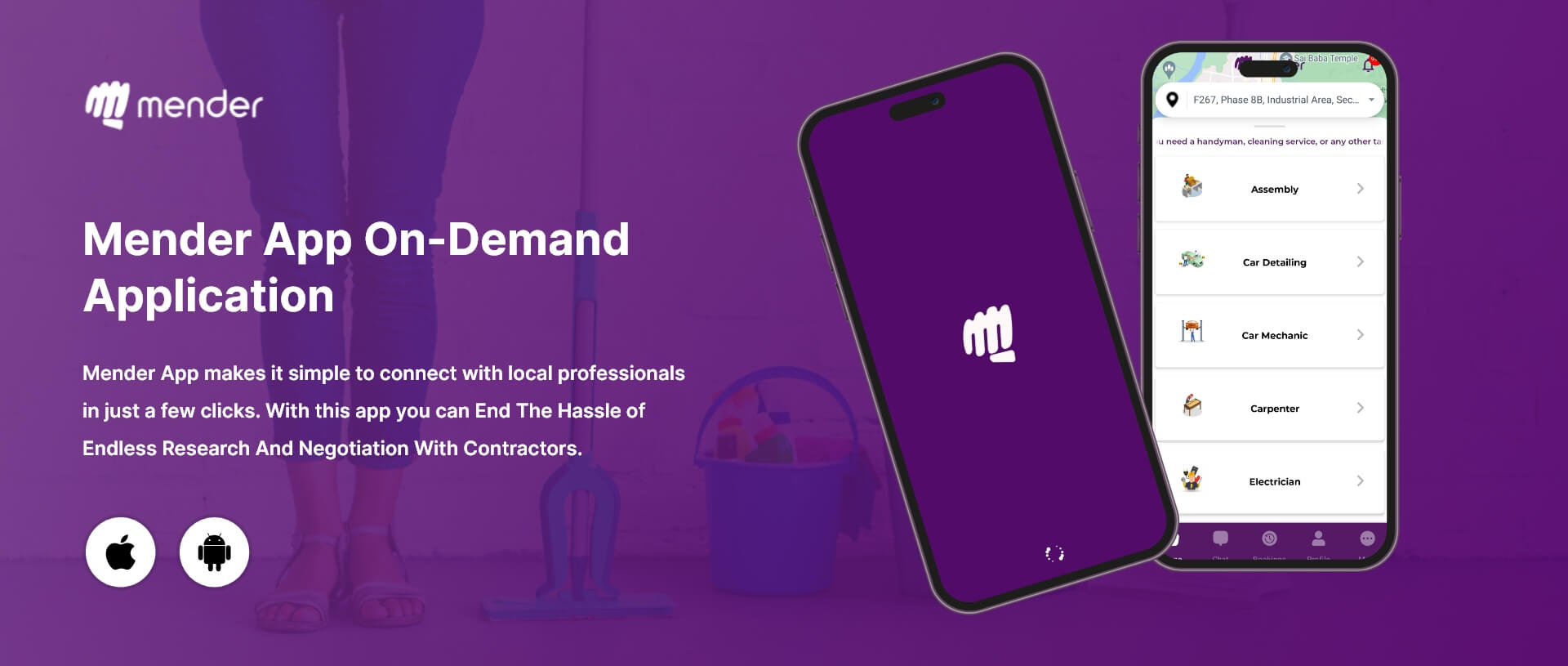

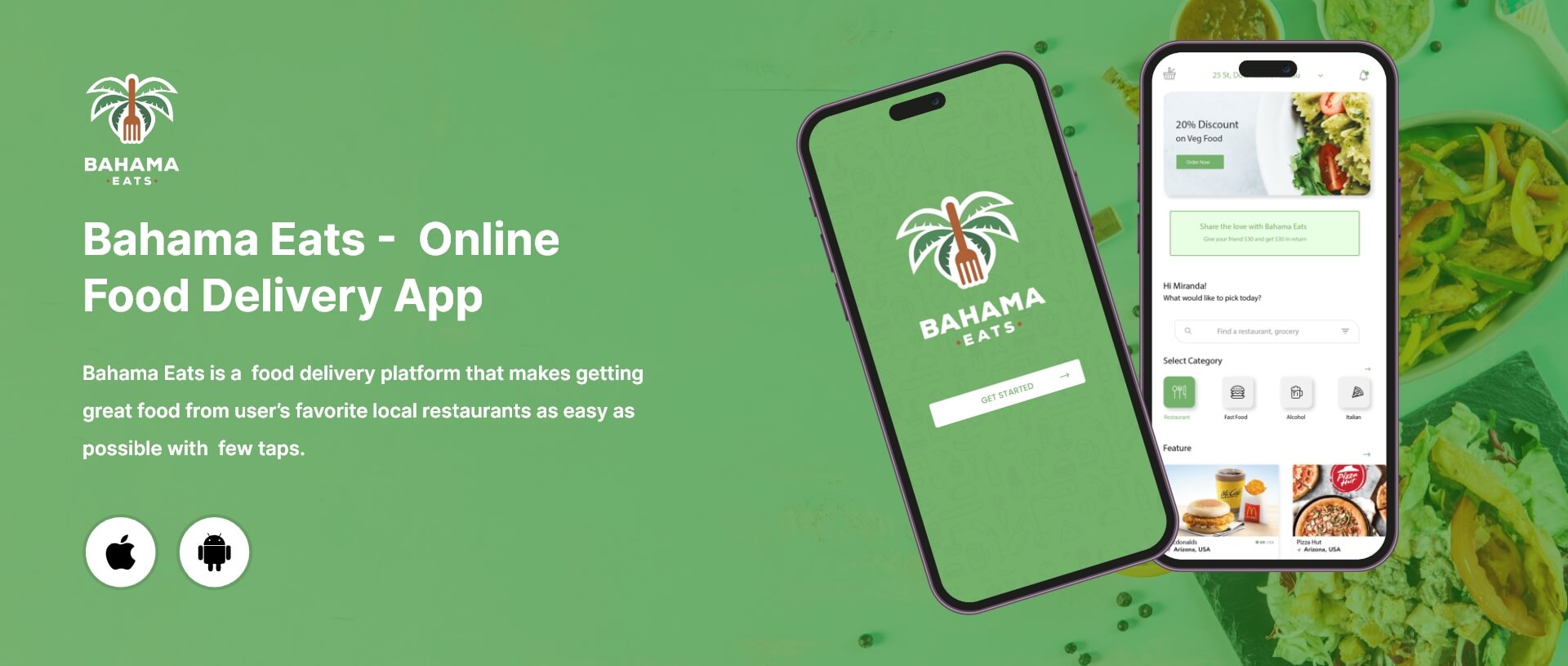

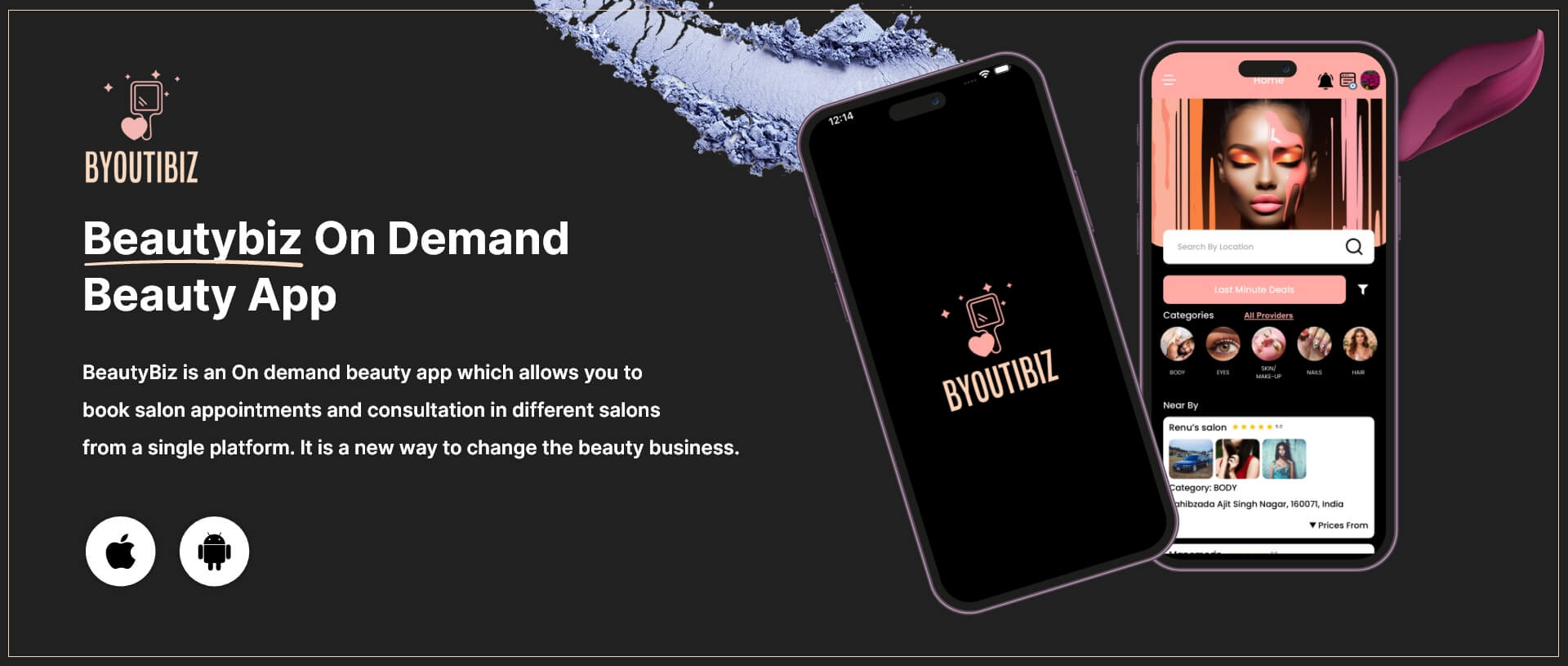

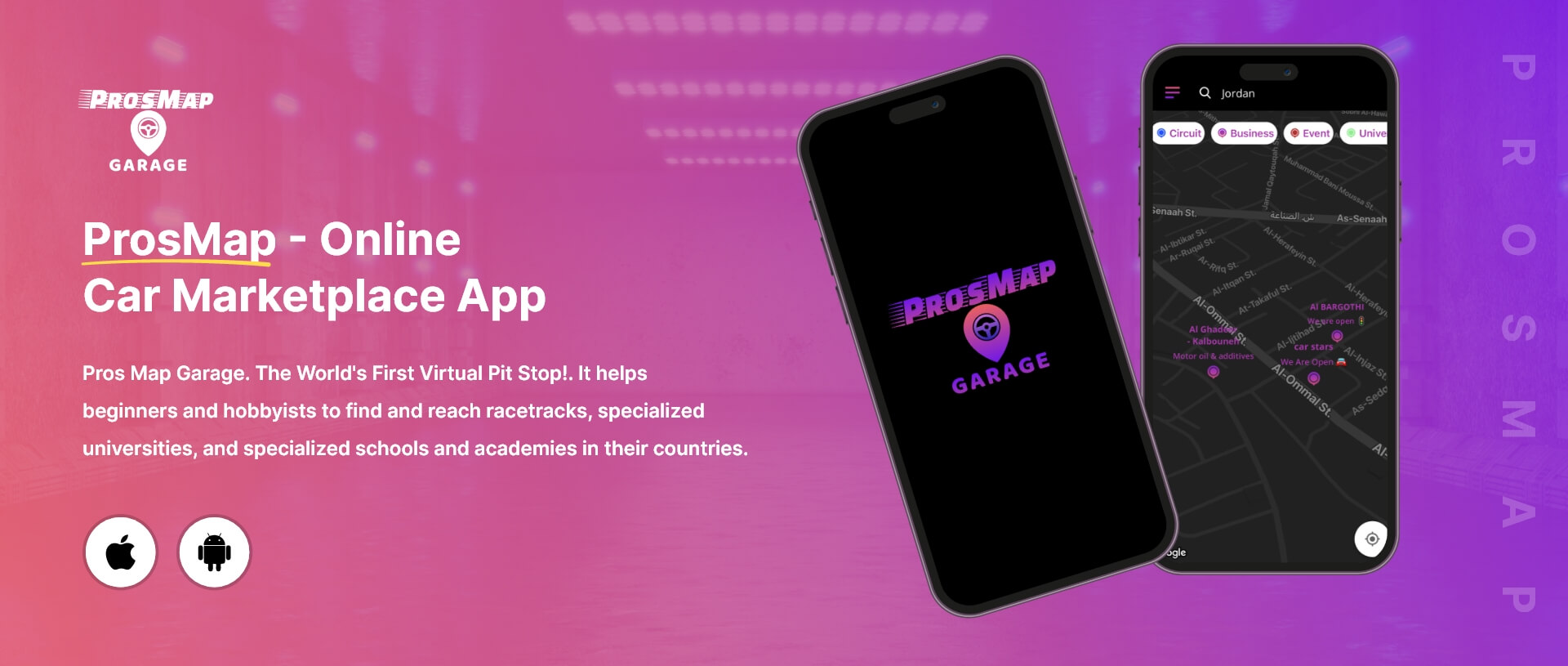

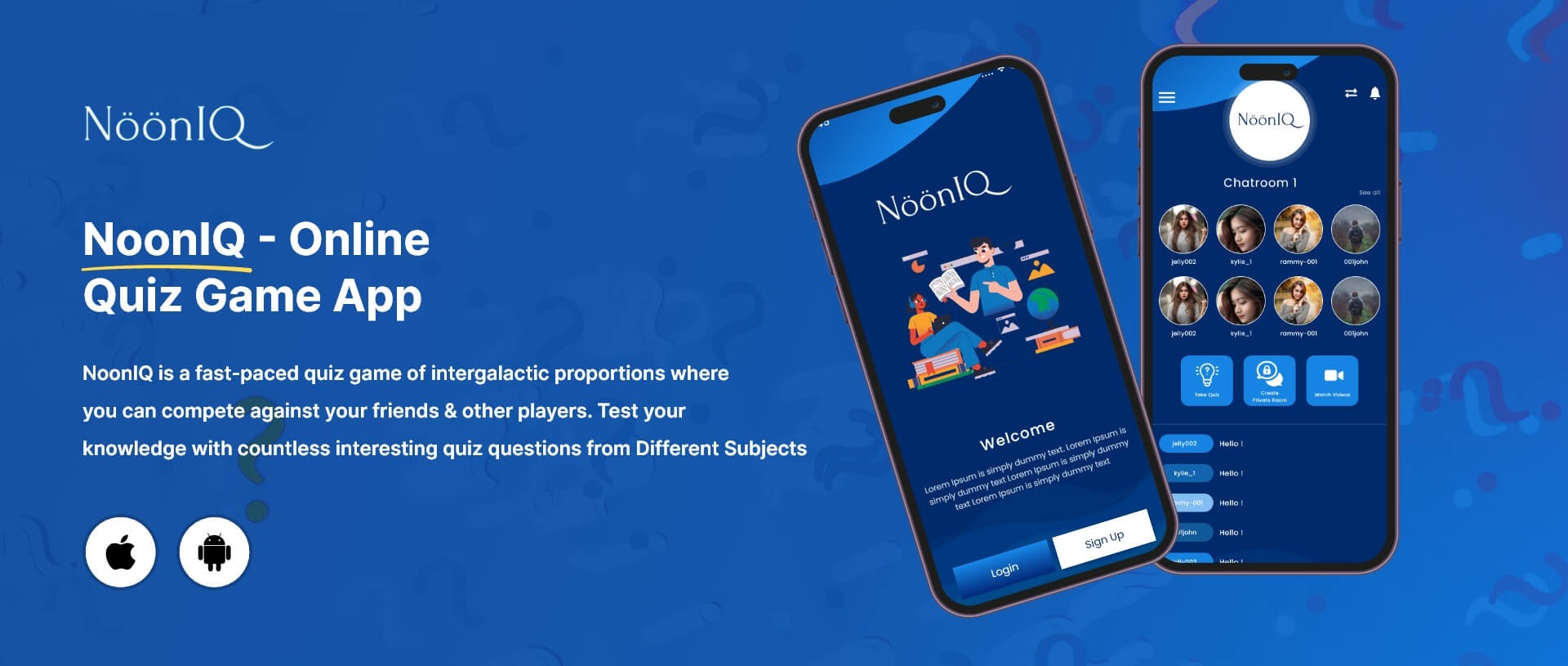

Introducing Our Stellar Portfolio

of Launched Startups

Recognized Globally for Excellence

We have been featured and certified by recognized authorities worldwide.

12+

Years of Industry Experience

3000+

Custom Mobile App Delivered

950 M+

Fund Raised for Clients

Revolutionizing Businesses: Tech Solutions Beyond Borders and Platforms

CQLSYS Technologies stands as a premier global IT services provider, reshaping digital landscapes for nearly a decade. With a dedicated team of over 150 tech enthusiasts, we craft bespoke digital solutions, empowering our clients to lead their industries with confidence.

Unlocking Competitive Advantages with Tailored Software Development Lifecycle Mastery

Leveraging Custom Software Development Lifecycles to Anticipate and Fulfill Future Business Demands

Innovating Solutions: Redefining Industry

Timelines with Our Development Process.

Our Services

Engineering Enhanced Business Experiences through Advanced Technological Solutions

As a premier app development company with a global presence spanning the USA and India, Cqlsys Technologies has partnered with over 4500 businesses, ranging from start-ups to enterprises, delivering top-tier solutions across industries. Our comprehensive suite of IT consulting services is tailored to meet the unique needs of each business, ensuring optimal outcomes based on individual requirements.

Contact Us

Bring Innovation Together!

Reach out to the team of the most innovative IT transformation Team and bring the transformation you need.

Drop Your Queries1. Small

Business!

Our adept professionals specialize in crafting brand identities that seamlessly integrate their extensive development experience with your unique requirements, ensuring a tailored approach to building your brand identity.

2. Startups

Operating on a tight budget with limited resources? Fear not. Our seasoned professionals provide invaluable tech support, transforming your dream idea into a tangible reality, regardless of constraints.

3. Agency

Business

Supercharge your agency's offerings by tapping into our unparalleled development expertise and cutting-edge technologies.

4. Enterprise

Business

We empower enterprise-level businesses to extend their business reach and optimize processes through innovative technology solutions.

Tailored Solutions for Your Business Needs

Fueling Startup Success: Launch to Growth

Awards & Recognition

We have been featured and certified by recognized authorities worldwide.

Client Testimonials Speak for Our Excellence

Discover Why Our Clients Choose Us and Hear Their Success Stories, Testifying to Our Exceptional Service and Results

FAQ

If you don't see an answer to your question, you can send us an email from our contact form.

Mobile app development services are professional services offered by software development companies to create, design, and deploy mobile applications for various platforms such as Android, iOS, or cross-platform mobile apps.

Mobile app development services provide many benefits such as increased business revenue, brand recognition, customer engagement, and customer retention. Mobile apps can also improve the efficiency of your business processes and help you reach a wider audience.

To find the right mobile app development service provider, you should look for a company that has experience in developing mobile apps for your industry. You can also check their portfolio and client testimonials to get an idea of their capabilities and quality of work.

The mobile app development process typically involves several stages such as ideation, wireframing, designing, development, testing, and deployment. The process may vary depending on the specific requirements of the project.

The timeline for developing a mobile app depends on various factors such as the complexity of the app, the number of features, and the platform on which it is being developed. Typically, it can take anywhere from a few weeks to several months to complete the project.

The cost of developing a mobile app varies depending on several factors such as the complexity of the app, the number of features, and the platform on which it is being developed. The cost can range from a few thousand dollars to several hundred thousand dollars.

You should provide the mobile app development service provider with your business requirements, the features you want in your mobile app, and any specific design or branding guidelines you want to be incorporated into the app.

The mobile app development service provider should provide you with ongoing support, including maintenance, bug fixing, and updates to the app. The level of support may vary depending on the agreement you have with the service provider.

CQLsys Bring Transformation For Global Businesses

Starting from listening to your business problems to delivering accurate solutions; we make sure to follow industry-specific standards and combine them with our technical knowledge, development expertise, and extensive research.

4500+

Apps Developed

1200+

Developers

2200+

Websites Designed

140+

Games Developed

120+

AI & IoT Solutions

2700+

Happy Clients

120+

Salesforce Solutions

40+

Data Science

Featured Blogs

Welcome to our journal. Here you can find the latest company news and business articles.

View All