Experience innovative mobile solutions with the power of Creativity,Quality,Leadership

We help visionary entrepreneurs to grow their business through quality it services.

Get A Free Quote

OUR EXPERTISE & SERVICES

We deliver robust, scalable, and reliable software product solutions to clients.

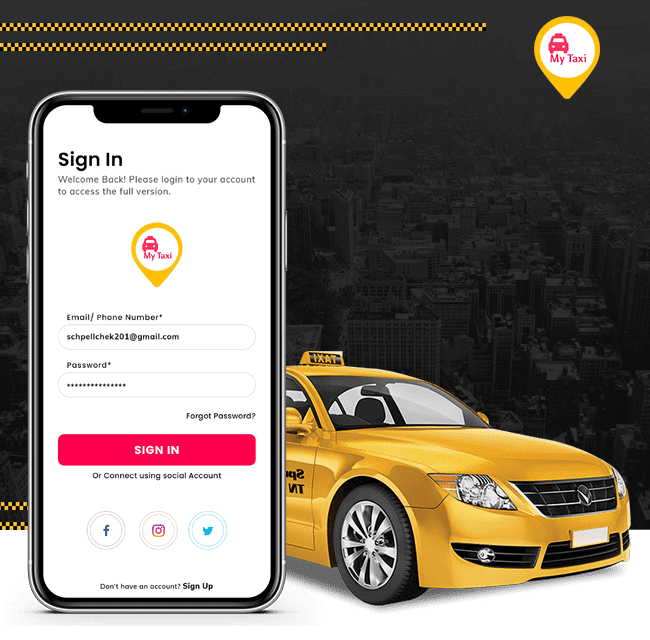

Mobile App Development

Creating Android, Hybrid, Native, Cross Platform & Hybrid Apps For all Industries

Learn More

Website Development

Delivering Responsive, Scalable, Customer Centric & SEO Friendly Websites.

Learn More

Revolutionise Your Business with Our Mobile App Mastery! Explore Bahama Eats: Your Ultimate Food Delivery Companion

Bahama Eats is an on-demand Delivery service for Restaurants, groceries, and Alcohol. Delivered right to your door in The Bahamas.

See ProjectEnd the hassle of endless research and negotiation with contractors! Mender App - your ultimate solution

Stop wasting hours researching and negotiating with contractors. Save time, energy—and your project with Mender App!

See ProjectConnect, chat, discover! Nearby: Your gateway to meeting new people and exploring thrilling local events.

Nearby lets you chat, meet new people, and find exciting events right in your local area. Stop struggling to make friends when the world is full of good-hearted individuals hoping to connect just like you.

See ProjectRev up your journey with ProsMap Like App! Navigate the world like a car enthusiast. Discover unique routes & destinations.

The idea is how most car enthusiasts see the world map, developed in the form of an application and a website to facilitate searches, and help beginners and hobbyists to find and reach racetracks, specialized universities, and specialized schools and academies in their countries.

See ProjectA Thoughtful Process

Discover: Initially, we carefully listen to your concept to uncover the fundamental essence of your business goals.

Complete range of services to turn your great ideas into profitable business.

Design

This means designing a strategy that will best support the user’s total experience, end-to-end.

Develop

Our creative team collaborates with the development team to ensure accurate coding.

Deploy

If an app never launches, it's like a rocket that's built to fly but remains grounded and useless.

Maintenance

We strive to give the best Maintenance Administration to keep your system/product functioning well after being Deployed to market.

Awards & Recognition

We have been featured and certified by recognized authorities worldwide.

Why Choose Us?

We bring solutions to make life easier.

Quality Assurance

Our goal is to provide products of exceptional quality, which is why we pay close attention to every detail at a granular level.

Reliability & Improved data

The individuals in our teams possess industry-specific domain knowledge and are highly skilled and certified engineers.

Flexible Availability

We prioritize our clients' requirements and ensure transparency throughout the development process.

Competence Performance

Our team is comprised of skilled developers who possess domain expertise across a range of industries

CQLsys mobile apps

Find Solution according to your Business need

Featured Blogs

Our Clients Projects

Businesses that become brands with us

5K+

Live Businesses

180+

Countries

5M+

Users

Meet Our Clients

Award winning projects making news Worldwide.

Check out Glimpse of words from some of our Happy Clients over worldwide.

Ready, set, build!

Car Swap

CarSwap is Australia #1 Car Trading App. Carswap is the world's peak vehicle trading website. With the biggest selection..

Sheldon Powell

“Best Portfolio Management App C/bbean 2017 Award winner. Invest like the best. With the Billionaire’s League app.”

QEDed

QEDed matches you with the best tutors required on your special needs. Whether you are a parent.

Katerina Makuch

Honestly, I've worked with him on the project for over a year and he exceeded my expectations! I will be continuing service with him!

Ulanda Spencer

The experience has been great so far. Fast communication and he has been ahead of schedule which is extremely helpful. Will work with him again.

Anetlouis

Ajay is an experienced developer and is easy to work with. I will rehire him any day and highly recommend him as well.

Katya

From the outset, their communication was clear and prompt, ensuring all my needs and concerns were addressed. The quality of work delivered was exceptional, exceeding my expectations in both creativity and efficiency

Let's Get Started!